PRESS RELEASE FROM COUNTY EXECUTIVE’S OFFICE:

PRESS RELEASE FROM COUNTY EXECUTIVE’S OFFICE:

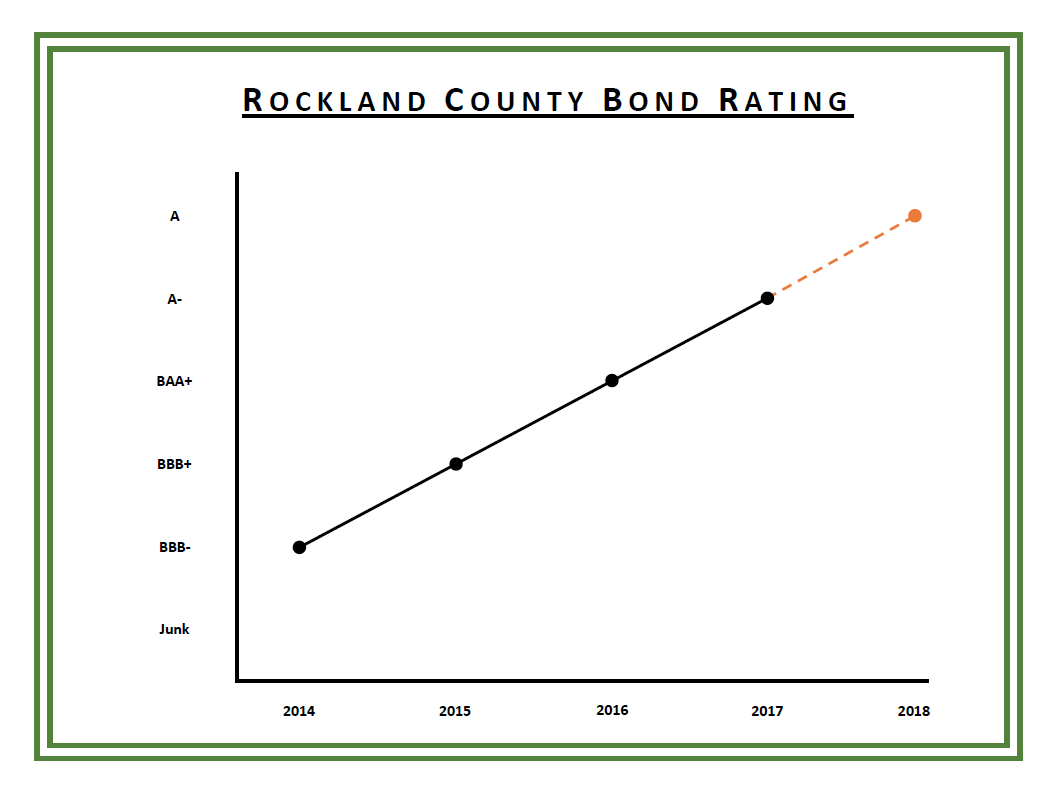

Rockland County Executive Ed Day announced today that for the first time in a decade Rockland’s bonds are in the “A” category, a clear sign that fiscal policies he put into place are paying off for taxpayers.

The “A-“ rating by Fitch is the county’s fifth consecutive bond upgrade since 2014, when Rockland’s bonds were rated just above junk and the county had a $138 million deficit.

“This is a development that matters to every person who pays taxes in Rockland County,” Day said. “It means that we can borrow money as we do regularly to fund capital projects at a lower cost.”

For a $30 million new issue 20-year-bond the difference between an “A” rating and a “B” rating is between $350,000 and $500,000, according to Rockland Commissioner of Finance Stephen DeGroat.

Rockland County has saved between $3 to $5 million in debt service since 2014.

“That is equivalent to a 3 to 5 percent property tax increase that did not happen due to our fiscal responsibility,” Day said. “Think about it – that is 3 to 5 percent a year that your property taxes did not go up.”

Rockland County’s improved financial health has earned the trust of the financial markets, which are willing to pay a premium to invest in the county.

Rockland earned $11 million in premiums from its $96 million deficit reduction bond sale and $20 million in total premiums on all bond sales since 2014.

“This is how we are driving the deficit down without raising your property taxes,” Day said. “That is what fiscal responsibility and the implementation of our era of renewal means to you, the taxpayer.”

The County Executive said that Rockland’s improved finances are a result of the efforts of many people.

“We thanks all of our talented and hardworking county employees, who have learned to do things differently, often more efficiently,” he said.

The size of county government has been reduced by 22 percent and spending has been cut by 9 percent.

“We have halted the endless tax-and-spend cycle that helped turn Rockland into the most fiscally stressed municipality in New York,” Day said. “That cycle burdened taxpayers with increases of 30 percent, 18 percent and 11 percent in the three years before I took office and shook the county to its core.”

Rockland is now seeing the payoff in terms of greater financial stability and an improved bond rating, he said.

“We are poised to move into the future with our finances in top shape,” he said.

The County Executive noted that the Fitch analysts rated Rockland’s bonds as “A-” with a stable outlook.

They made the rating with the expectation that that the county will eliminate its deficit and build up reserves.

“I hear what they are saying very clearly and I hope that the Legislature hears it too: If we do not bring down our deficit we risk all of the hard-won gains we have made. We could see our bond rating trend down again,” Day said. “That means money lost and higher taxes. Remember those double-digit tax increases? We don’t want to go backward.”

Sale of the county-owned Sain building for $4.51 million would allow the county to reduce its remaining $10 million deficit by 40 percent.

“Just about everyone understands that the sale of the deteriorating Sain Building is crucial to the county’s future,” Day said. “Everyone but a certain group of 5 legislators. We know who they are and the voters of Rockland County know who they are. We remain hopeful that they will put their petty political games aside and do the right thing for the future of Rockland County.”

PRESS RELEASE FROM COUNTY LEGISLATURE:

Yet another credit rating agency has boosted Rockland County’s score, with Fitch Ratings upping the county from “BAA Plus” to “A Minus.”

“This new rating is further evidence that the difficult decisions made by the Legislature have continued to help turn things around when it comes to our finances,” Legislature Chairman Toney L. Earl said.

“But many issues remain, including paying down the rest of the deficit and reducing our fiscal stress score so that we are no longer considered strained,” Earl said.

Fitch is one of several rating companies that issue scores regarding the credit-worthiness of Rockland County, the others being Moody’s and S&P Global Rating.

Rockland’s credit score once stood just three positions above junk status as the recession took a heavy toll, in good part because, at the time, the county over-relied on more volatile sales tax revenue instead of more dependable property tax revenue, according to the state Comptroller’s Office.

But the Legislature’s hard work – and difficult decisions – have repeatedly been shown to contribute to the turn-around of the county’s finances

Legislator Michael Grant, who chaired the Legislature’s Budget and Finance Committee for many years and is currently the committee’s Vice Chair, cited several specific actions taken by the 17-member bipartisan County Legislature that have contributed to the rating improvements. They include:

- The Legislature approved a deficit reduction bond in 2014 in the amount of about $96 million to quickly pay down a major portion of the county’s approximate $138 million budget deficit. The loan dramatically improved cash flow, which had a direct impact on the county’s fiscal stress score. The bond is in process of being paid off.

- The Legislature has made a concerted effort to eliminate the remaining outstanding deficit by setting aside $5 million to help pay it down in the 2015 county budget, and an additional $1 million in the 2016 county budget. The Legislature’s effort to include $4 million for deficit reduction in the 2017 budget was vetoed.

- The Legislature formalized a fund balance management policy by adopting Local Law No. 4 of 2013, cited by both Fitch and S&P Global Rating as necessary for the Country’s overall financial resilience.

- The Legislature, in each year since the Deficit Financing Act was passed, has responded to the advice of the state Comptroller’s Office and the signals sent by credit rating agencies to pay down the deficit, restructure revenues and address challenging expenditures.

- A steadily improving economy, both regionally and nationally, has contributed to the improvements of Rockland’s overall fiscal condition.

“More work and more difficult decisions will be required of County government to truly restore our fiscal house to good stead,” Grant said. “Clearly the Legislature has made the right choices to address the issues and I am sure that will continue. Working for the best interests of our taxpayers and residents is the only goal.”

Earl also acknowledged the work of the Administration in trying to better the county’s finances.

Among the issues still to be addressed: Paying down the remaining deficit, determining the future uses of vacant government office space in New City and Pomona, and avoiding breaking the tax cap.

“The Legislature has spent countless hours developing detailed responses to the fiscal crises we have faced in recent years,” Earl said. “It is important that we have detailed information about every issue we grapple with and that we try to avoid one-shot answers. We were forced to do that in the past and no one was happy about it. We are not pressured to do so now, thanks to the decisions we made regarding the budget.”

You must be logged in to post a comment Login